Key Outcomes

- Over 1,000 hours of manual work saved annually

- Hundreds of compliance reviews streamlined each year

- Enhanced efficiency in Information Security and Regulatory Compliance

A Growing Challenge in Compliance

One of the leading Banking-as-a-Service institutions in the U.S. has been at the forefront of financial innovation, supporting numerous fintech partners and serving millions of customers. With assets reaching $4.2 billion and a rapidly expanding network of partners and vendors, the bank faced a critical challenge: keeping up with compliance reviews.

Traditionally, compliance analysts manually reviewed anywhere from a single document to hundreds, answering a series of regulatory questions. Some reviews took hours, while others required uninterrupted days of work. As business growth accelerated, the backlog of pending reviews became unmanageable, demanding a smarter solution.

A Smarter Approach with AI

Recognizing the need for a scalable, efficient solution, the bank partnered with Cavallo Technologies to revolutionize its compliance review process. Leveraging cutting-edge AI, our team developed an advanced system powered by Large Language Models (LLMs) and Retrieval-Augmented Generation (RAG).

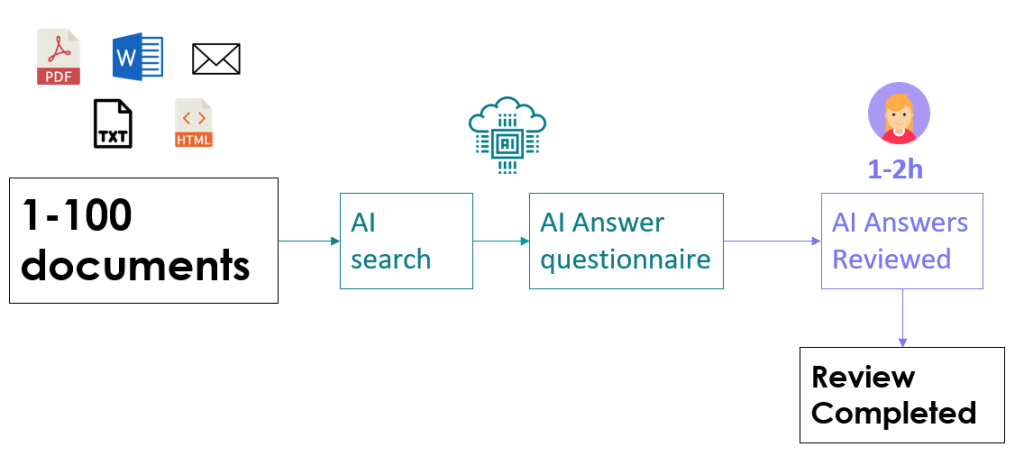

Instead of manually searching and analyzing documents, compliance analysts now receive an AI-prepared review document, complete with pre-filled responses and references. The AI system:

- Ingests relevant documents

- Extracts critical information

- Generates answers for required compliance questions

Analysts simply verify and refine the AI-generated responses, drastically reducing review time and ensuring consistency and accuracy.

Delivering Innovation with Databricks and Secure AI

Cavallo Technologies built the solution on Databricks’ Data Intelligence platform, incorporating Meta’s latest open-source LLM, LLaMA 3.2. Hosted securely within the client’s data environment, this approach ensures that sensitive regulatory and contractual documents remain protected.

Throughout development, our team worked closely with compliance experts, refining the system through iterative testing. Enhancements such as document chunking, optimized prompts, and intelligent question framing further improved accuracy and efficiency.

Real Impact: Time Savings and Increased Productivity

The AI-powered system quickly demonstrated its value. Even before its full deployment, business stakeholders recognized its potential and began applying it to real-world cases. Now fully integrated, the system has transformed compliance operations:

- Each review now takes up to 10 hours less to complete

- With over 100 reviews conducted annually, this equates to 1,000+ hours saved per year

- Compliance and Information Security teams can now focus on higher-value tasks instead of manual document processing

By embracing AI-driven compliance automation, our client has not only improved efficiency but also positioned itself for sustained growth in an increasingly complex regulatory landscape.

Looking Ahead

This AI solution marks a significant milestone in modernizing regulatory compliance. As financial institutions continue to navigate evolving regulations, intelligent automation will be key to maintaining agility, accuracy, and compliance excellence.

Cavallo Technologies remains committed to driving innovation and empowering organizations with AI-driven solutions that deliver measurable impact.